Rob Nelson watched the kid’s ritual with curiosity. It was the mid-1970s, and he and the kid were in Civic Stadium in Portland, Oregon, both working in the service of the Portland Mavericks, a rogue baseball team operating outside the purview of Major League Baseball. Nelson was a fledging player who sometimes got on the field but mostly stuck to selling tickets and coaching youth baseball camps. The kid, Todd Field, was the batboy. And what Field was doing fascinated Nelson.

Field, who couldn’t have been older than 11 or 12, took a Redman chewing tobacco pouch from his pocket, scooped out of a bunch of gunk, and stuffed it between his cheeks and gumline. Then he’d let the black goo dribble down his chin or hock it in the dirt.

Chewing tobacco was a common sight among the athletes, but Nelson hadn’t seen many kids take up the habit so early. He approached Field and asked if he was dipping, the common parlance for stuffing tobacco in one’s cheek pockets.

Field hocked another glob of brown discharge at the ground. He showed Nelson the tobacco tin, which was full of black licorice. Fields had minced it up so that he could replicate the muddy color of the real thing.

The exchange planted a seed in Nelson's brain. As a kid, he had done something vaguely similar, stuffing his mouth with bubblegum to resemble his idol, Chicago White Sox second baseman Nellie Fox. What if, he wondered, kids could emulate their heroes without the health consequences or parental scorn that accompanied real tobacco?

Not long after, Nelson found himself in the team’s dugout with Jim Bouton, a onetime New York Yankee who had been ostracized for writing a tell-all memoir, Ball Four. Nelson shared his idea for a novelty faux-tobacco product with Bouton, but with something of a twist: Instead of licorice, he would use shredded bubblegum. He might, he said, call it Maverick Chew, or All-Star Chew.

Bouton was intrigued. As the two watched the Mavericks players jog around the field and dip real tobacco (neither man had ever taken up the habit) they agreed it would be an idea worth pursuing. Nelson would develop the product and Bouton would try to get it distributed. Bouton would also be the sole investor, sinking $10,000 into Nelson’s idea.

The Mavericks disbanded in 1977, but the partnership between Nelson and Bouton endured. Nelson, who worked for a pitching machine company, visited Bouton after the pitcher signed with the Atlanta Braves in 1978, and the two conspired further on Nelson’s shredded gum idea. Nelson purchased an at-home gum-making kit that he saw an ad for in the pages of People magazine and got to work producing a batch of the stuff in the kitchen of Field’s parents. Hoping to mimic the tar-like color of Field’s concoction, Nelson used brown food coloring, maple extract, and root beer extract in the gum. The result was predictably terrible.

Despite a lack of a viable prototype gum, Bouton did his part by pitching the idea to several baseball-affiliated companies. (The former Yankee put his own likeness on the mock-up pouch.) Topps and Fleer, which produced bubblegum cards, politely rejected him. He eventually ended up at Amurol, a subsidiary of the Wrigley Company, one of the largest chewing gum conglomerates in the world. In a coincidence, Amurol engineer Ron Ream had been working on a shredded-gum project for several years. Rather than brush Bouton off, the company embraced the idea of a gum that would be sold in a pouch and was a play on kid-friendly chewing tobacco. They even liked the name Nelson had settled on: Big League Chew.

Ream had successfully developed a formula that solved the problem of the tiny ribbons of gum, using enough glycerin to make sure it wouldn’t stick together and become a useless clump in the package. Amurol, however, didn’t take to Nelson’s other big idea, which was to make the gum brown. While the chewing tobacco homage was obvious, they didn’t want to completely replicate the experience. The gum would remain pink.

In 1980, Amurol conducted a sample rollout at a 7-Eleven store in Naperville, Illinois. When executives came back from lunch, the 2.1-ounce pouches had sold out.

That first year, Big League Chew rang up $18 million in sales, capturing 8 percent of the bubblegum market. Amurol’s other products all together hadn’t totaled more than $8 million. (Nelson and Bouton received a percentage of sales.)

Nelson’s hunch had been correct: Kids loved the facsimile chew, which sold for between 59 and 79 cents a pack. Candy distributors in Orlando reported selling 25,000 pouches a week. Copycat products like Chaw came and went. Little Leaguers and amateur ballplayers could take out as much gum as they wanted and stuff the rest in their pockets. But the association with tobacco, which wasn’t meant to be taken literally, upset some parents. They feared Big League Chew could become a "gateway" gum—bubblegum one day, tobacco and oral cancer the next.

Nelson and Amurol took the criticism in stride. Nelson was often quoted as saying he personally detested chewing tobacco and considered this a solution to, not the cause of, a tobacco habit. A California bill that would have banned the gum, candy cigarettes, and other products meant to resemble tobacco died in the state’s Senate Judiciary Committee in 1992. Kids continued to dribble grape, strawberry, and other fruit-flavored gum on their shirts. Amurol experimented with gum branded with Popeye’s likeness, colored green and meant to resemble spinach. It did not enjoy the same success.

Nelson bought out Bouton’s interest in Big League Chew in 2000 and has remained with the brand ever since, including a move from Wrigley—which was sold to Mars Inc. in 2008 for $23 billion—to Ford Gum in 2010. Sales have hovered around $10 to $13 million annually and there have been no confirmed reports of children being indoctrinated into a chewing tobacco habit as a result.

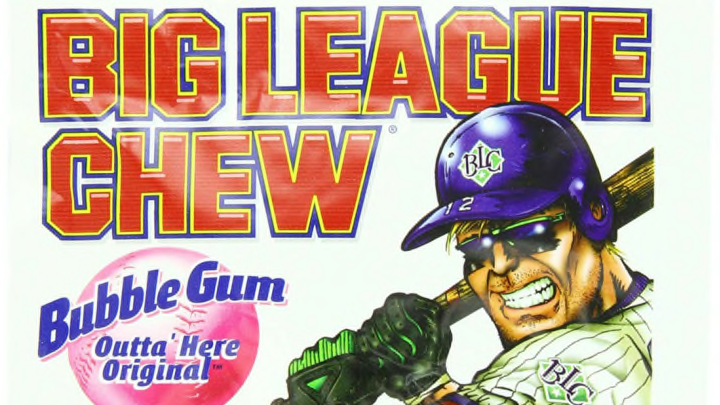

In February 2019, the package depicted its first female player. In the past, it has featured a variety of artwork and the likenesses of several retired players. In 2013, two active players—Matt Kemp of the Los Angeles Dodgers and Cole Hamels from the Philadelphia Phillies (now with the Chicago Cubs)—were pictured. But despite its name, Big League Chew has never had any formal affiliation with Major League Baseball. The MLB has instead maintained relationships with Bazooka and Double Bubble.

The lack of any official MLB endorsement hasn’t hurt. At last count, more than 800 million pouches of Big League Chew have been sold.