Protecting your sensitive personal information is more critical than ever. In 2023, over a million Americans reported cases of identity theft to the Federal Trade Commission (FTC). More than 856,000 of those complaints were due to imposter scams, wherein a person poses as part of a business or government agency to capture private details about your life. Recovering from these scams doesn’t come cheap, as recent data from the FTC also revealed that Americans lost more than $10 billion to fraud in 2023, up 14 percent from the previous year.

Data breaches are getting worse, too. A new lawsuit alleges that the hacking group USDoD breached the unencrypted personal information of approximately 2.9 billion people in April 2024 from National Public Data, a company specializing in background checks. The stolen data file, which includes known relatives and address histories, reportedly goes back at least 30 years and was leaked for free on a public forum in August 2024.

With so many potential risk factors to keep in mind, it’s important to stay alert. But safeguarding your name, birthday, Social Security number, passwords, and credit card numbers can be a big job. Here are 11 useful ways to protect yourself against identity thieves who want to steal your information to rack up purchases, open accounts in your name, or file fraudulent tax returns.

- Freeze your credit.

- Sign up for mobile banking alerts.

- Monitor your credit reports.

- Don’t be lazy about passwords.

- Be wary of unsolicited emails.

- Opt out of pre-screened offers from credit card companies.

- Use a cross-cut shredder.

- Limit what you share on social media.

- Secure your mailbox.

- Keep important documents in a safe.

- Use antivirus software and a VPN.

Freeze your credit.

If you aren’t planning on applying for any new loans or credit cards in the foreseeable future, you may want to consider freezing your credit. Doing so means that no one can access your credit report outside of certain financial institutions where you already have existing accounts. This is a pretty useful deterrent to would-be hackers, as they won’t be able to get a hold of that valuable personal information themselves or be able to use it to open up any new accounts in your name while it’s in place.

To get started, you’ll need to send requests directly to each of the major credit reporting bureaus—Equifax, Experian, and TransUnion—and provide some details, including your Social Security number, recent address history, and date of birth. Once your credit is frozen, it’ll stay that way for either a set period or until you request to reverse it, which you can do at any time by contacting those same three credit agencies and using the passcode they provide when you first request the freeze. You can still check out your credit reports whether the freeze is in place or not.

Sign up for mobile banking alerts.

Besides regularly reviewing your credit card and banking monthly statements, sign up for alerts. Most financial institutions will contact you by email or text when an uncharacteristically large withdrawal or purchase above a certain amount occurs. Download your bank’s official mobile app so you can monitor your accounts from your phone. And if you spot any unauthorized purchases, contact your financial institutions immediately.

Monitor your credit reports.

Every 12 months, you can get a free copy of your credit report from each of the three major credit reporting agencies. Read your credit reports to make sure that they don’t contain any incorrect addresses or accounts that you didn’t open. If you see something suspicious, contact the credit reporting agencies and your bank, stat.

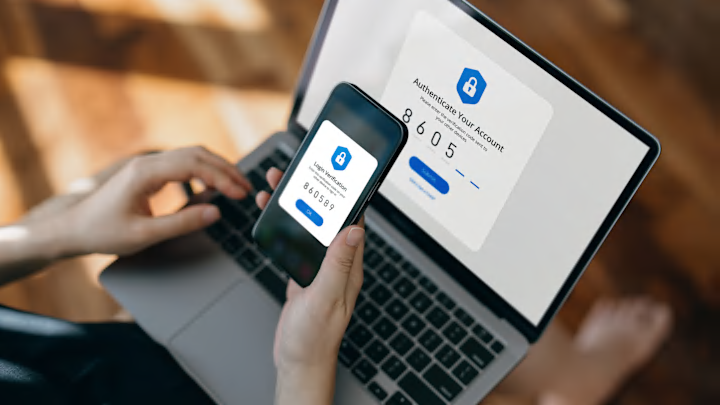

Don’t be lazy about passwords.

Saving passwords to your computer’s password keychain may save you time, but doing so can make you vulnerable to a security breach. Besides using complex usernames and passwords (random strings of letters, numbers, and symbols), you should change your passwords regularly, especially for your banking logins. And only sign in to banking websites when you’re on a private, trustworthy Wi-Fi network.

Be wary of unsolicited emails.

Identity thieves can trick you by sending you an email that looks as if it came from a legitimate company with which you do business. If these phishers send you an unsolicited email from what appears to be your bank, be careful. Don’t click on any links in the email, or you run the risk of getting malware installed on your computer. Scammers may also call you, claiming to be an employee of your bank and asking you to reveal your account number, Social Security number, or other personal information. Instead of responding, contact your bank directly (using the number on the back of your card) to find out if the email or call is legitimate.

Opt out of pre-screened offers from credit card companies.

The only thing worse than an unsolicited email is an unsolicited pre-screened credit card offer. These pieces of junk mail can be like catnip for identity thieves, especially when they show up in your literal mailbox (but more on that later). Because your credit report doesn’t reflect pre-screening inquiries, keeping track of them and preventing them from falling into the wrong hands can also be nearly impossible.

Luckily, there is a way to completely opt out of these kinds of communications from credit card companies. The FTC recommends heading to optoutprescreen.com or calling 1-888-5-OPT-OUT (1-888-567-8688). You can choose to keep the ban in place for five years or permanently, and while you'll still receive some offers—possibly from local businesses or those you already shop or frequent—the vast majority will no longer darken your mailbox.

Use a cross-cut shredder.

The internet allows plenty of fun new opportunities for hackers to steal your identity, but low-tech identity thieves aren’t yet a thing of the past. Because these thieves steal your trash, looking for mail or other documents that contains your personal information, it’s important to get in the habit of using a cross-cut shredder. Before you throw them out, shred any credit card offers, bank statements, utility bills, receipts, and even the labels on your prescription pill bottles.

Limit what you share on social media.

Identity thieves love over-sharers. Whether you share your birthday on your LinkedIn profile, your phone number on Facebook, or your pet’s name on Twitter, you’re making yourself vulnerable to identity thieves who may be on the hunt for answers to your security questions. For all your social media accounts, make sure your privacy settings are strong, you aren’t friends or connections with people you don’t know, and you haven’t unknowingly shared too much personal information.

Secure your mailbox.

Some identity thieves steal mail from mailboxes, hoping to find bank or credit card statements, pre-approved credit card offers, and other sensitive documents. To safeguard yourself against this type of identity theft, put a lock on your mailbox and retrieve your mail as soon as possible after it’s delivered. If you have outgoing bills to send, drop them off at the post office (or a secured drop-off box) instead of leaving them in your unlocked mailbox. And when you leave town, get a mail hold from the post office so your mail doesn’t pile up.

Keep important documents in a safe.

Putting all your important documents in a safe can protect your information from getting into the wrong hands. Keep your Social Security card, passport, birth certificate, extra checks, copies of your health insurance cards, and a printed page of your important passwords in a safe. Just make sure to bolt your safe to the ground, otherwise a thief can take the safe right out of your home.

Use antivirus software and a VPN.

Another crucial way to stay safe online is to be cautious about how you access the web in the first place. With the threat of malware—including spyware and viruses—on the rise, it pays to browse defensively. This means keeping your existing software as current as possible with regular updates and investing in the best antivirus software you can afford.

Antivirus software that monitors and detects malicious activity on your laptop or tablet can be invaluable, but consider adding a VPN to the mix. A VPN can make internet connections more secure and, as a bonus, allow users to conceal their private information, including IP addresses and overall browsing activity, from would-be peepers online. A reliable VPN can make it safer to use public Wi-Fi or access a company’s private network during international travel, too.

Get More About Personal and Online Security Tips Below:

A version of this story was originally published in 2016 and has been updated in 2024.